UK Car Production Crashes to Historic Low: Industry Faces Perfect Storm

Anúncios

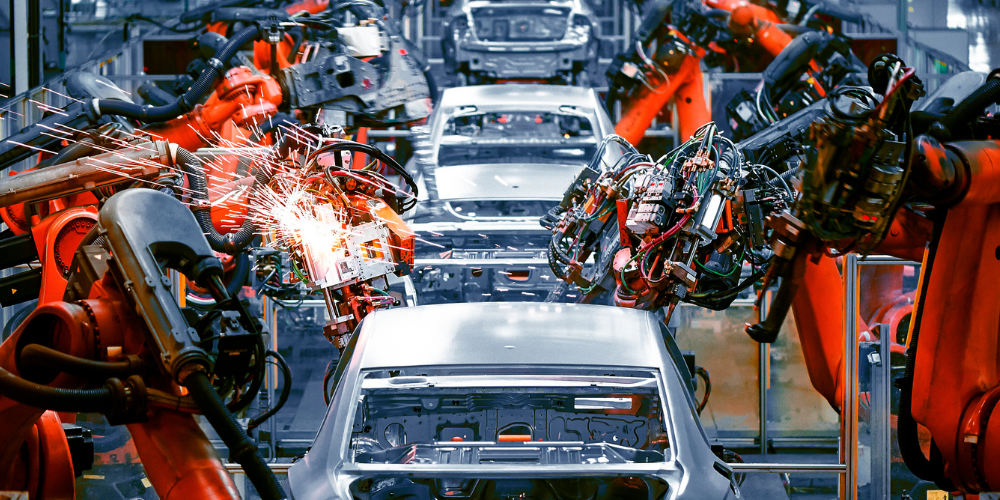

📉 A Historic Slump in British Auto Manufacturing

The United Kingdom’s automotive industry has experienced one of its most dramatic downturns in over seven decades, with car production in April plunging to its lowest level since 1952, excluding the pandemic-induced halt of 2020.

Only 59,203 vehicles were produced during the month, marking a 16% drop from the same period last year and a staggering 25% fall from March.

This significant decline has been attributed to several compounding factors, including:

- Fewer working days due to Easter

- Tariff impacts from U.S. trade policy

- Ongoing transition from petrol to electric vehicle (EV) production

- Export declines driven by weakening demand from the U.S. and EU

Based on the information from the Society of Motor Manufacturers and Traders (SMMT), the downturn illustrates both short-term shocks and longer-term structural shifts in the global automotive landscape.

Anúncios

🚧 Tariffs and Transatlantic Tensions

One of the most immediate contributors to the production decline was the implementation of U.S. import tariffs, driven by former President Donald Trump’s trade agenda.

- British manufacturers rushed to ship vehicles before the 25% U.S. tariff on steel, aluminum, and cars took effect in March, artificially boosting numbers that month and accentuating April’s drop.

- While a recent U.S. court ruling blocked many of Trump’s trade tariffs, it notably excluded the duties on automotive imports.

- Jaguar Land Rover (JLR) is now facing 27.5% tariffs on vehicles sent to its American operations, significantly raising costs.

It’s costing us a huge amount of money, said a JLR spokesperson, expressing frustration over the delay in enforcing a new UK-U.S. deal that would lower tariffs to 10% for up to 100,000 vehicles annually.

Anúncios

For now, British automakers remain caught in a regulatory bind, facing double taxation when exporting cars to U.S. subsidiaries, as both export and import duties are incurred.

🐣 Easter and Fewer Working Days Compound Problems

April’s calendar worked against the automotive sector, too.

The Easter holiday falling in April meant fewer production days, further contributing to the slump.

The SMMT compared this year’s April output to historical records and found it to be the lowest since 1952, excluding 2020.

While seasonal patterns always affect output, this drop was especially pronounced due to the overlap of several disruptive factors.

📊 Exports Hit Harder Than Domestic Demand

According to SMMT, the sharpest blow came from the export segment:

- Exports dropped 10.1% in April.

- Falling demand from the U.S. and EU, the UK’s two largest export markets, drove much of the decline.

- Total vehicle production for January through April was the lowest recorded for that period since In 2009, at the height of the global financial crisis.

Domestic production fared slightly better but still showed weakness:

- Car production for the UK market declined by 3.3% year-over-year.

- According to Autotrader, while UK car sales (both new and used) are rising, manufacturers focused on exports are feeling the pinch more acutely.

The domestic market is solid. But export impacts are dragging down overall production, said Nathan Coe, CEO of Autotrader.

🌍 The Global Context: UK Is Not Alone

The downturn in production is not exclusive to the UK. Professor Peter Wells is the Director of the Centre for Automotive Industry Research at Cardiff University, emphasized that other major car-producing nations are also struggling, including:

- Germany

- Italy

- France

- Japan

This isn’t purely a UK problem,” Prof. Wells told the BBC.

But the UK may be more vulnerable to global pressures because of its trade exposure and uncertain EV policies.

⚡ EV Transition Adds Complexity

While transitioning to electric vehicle (EV) manufacturing is widely viewed as essential for the future of the automotive industry, it has caused short-term disruption in production volumes.

- Assembly lines are being retrofitted to accommodate EV production, slowing down traditional car output.

- Suppliers are undergoing transformations to meet the needs of EV components, leading to logistical delays.

Meanwhile, the UK government’s shifting stance on EV regulation has caused uncertainty:

- In April, the government relaxed EV sales targets and reduced emissions-related fines, prompting criticism for sending mixed signals to manufacturers.

- Several major brands, including Stellantis (maker of Vauxhall, Citroën, and Peugeot), have voiced concern about continued investment in the UK.

What the industry always wants is stability and clarity, said Prof. Wells.

Right now, there is volatility on almost every front, from tariffs to emissions to electrification.

🏭 Recent Closures and Industry Retrenchment

UK Automotive Sector Setbacks

| Company | Event | Year |

|---|---|---|

| ❌ Honda | Shut down its Swindon plant | 2021 |

| ❌ Ford | Closed its Bridgend engine factory | 2020 |

| ❓ Stellantis | Warned of halting production in the UK unless policy direction improves | — |

These closures reflect broader strategic shifts, as automakers reevaluate where to place long-term manufacturing investments.

The combination of tariff uncertainty, Brexit repercussions, and unsteady EV policies has placed the UK in a less favorable position than competitors in the EU and Asia.

🔍 Trade Barriers and Chinese Imports: A Double-Edged Sword

Another factor uniquely affecting the UK is its current position on Chinese imports. Unlike the U.S. and EU, the UK has fewer trade barriers in place, leading to:

- A potential influx of low-cost EVs and components from China.

- Increased competition for domestic manufacturers.

While these imports offer price advantages, they may also undercut UK production if local firms are unable to compete on cost or scale.

💹 Economic Reactions: Autotrader and Market Volatility

Even companies adjacent to manufacturing are feeling the economic ripple effects.

Autotrader, one of the UK’s largest online car marketplaces, saw its share price drop by 12% after reporting only a 5% increase in sales.

The company cited broader economic uncertainties and industry headwinds, signaling that even strong sales figures may not offset structural volatility in the automotive supply chain.

🛣️ What’s Next for the UK Automotive Sector?

Although the current data presents a grim outlook, there are signs that recovery and stabilization could be on the horizon — provided strategic action is taken:

- Implementation of UK-U.S. tariff relief: The 10% deal covering 100,000 vehicles annually could ease the cost burden significantly — if fast-tracked.

- Clarity on EV incentives and regulation: Manufacturers are more likely to invest if policy goals are consistent and enforceable.

- Leveraging new trade deals: Agreements with India, the EU, and other growing economies could open up alternative export markets.

💬 Final Thoughts: At a Crossroads

The UK automotive industry stands at a pivotal moment.

The convergence of tariffs, trade volatility, and technological transition has created a climate of uncertainty.

Yet, within this challenge lies opportunity.

We’ve seen crises before in automotive history.

What matters is how governments, industries, and global partners respond, Prof. Wells, Cardiff University

If policymakers and manufacturers align around innovation, transparency, and coordinated action, a path to sustainable recovery may well emerge.

For now, the road remains bumpy, but the wheels are still turning.